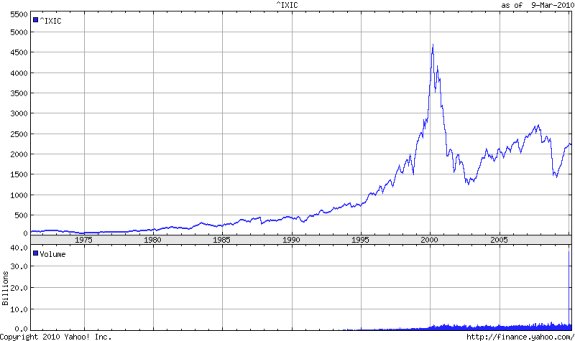

After hitting a peak on March 10, 2000, it took the Nasdaq more than two years to close at a bottom of 1,108.49 on October 9, 2002, and even today the index isn't even at half the level it was at the height of the dot com madness, and that's without taking inflation into account. More info about the dot com bubble can be read at CNET.

Even federal regulators, who ought to know better, took the claims of a new economy seriously. Minutes from the Federal Open Market Committee, released five years later, show that even Fed Chairman Alan Greenspan seemed to believe that the Nasdaq would continue to skyrocket.

"People in the front lines of business operations, such as Jack Welch of GE and Lou Gerstner of IBM, say this is a true revolution" rather than a stock market bubble, Greenspan said at a 1999 meeting. "They have seen nothing like this in their experience."

A few weeks before the Nasdaq peaked, Greenspan said that "we really do not know how this system works. It's clearly new. The old models just are not working."

Credit: Yahoo Finance