Posted on Wednesday, April 07 2010 @ 21:08 CEST by Thomas De Maesschalck

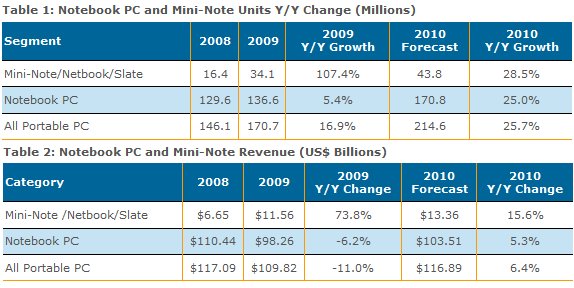

DisplaySearch published its quarterly report about the notebook market, predicting shipments of portable PCs will grow 25.7 percent year-over-year in 2010. Unit sales of regular notebooks are expected to grow 25 percent, while sales of netbooks/slate/mini-note devices are expected to increase by 28.5 percent.

For 2010, the total portable PC market is expected to grow to 215 million units and $117 billion, according to a new report by DisplaySearch, its Q1’10 Quarterly Advanced Notebook PC Shipment and Forecast Report. Dramatic increases in the size of the slate-style PC market are expected to be driven by the Apple iPad and slates from other PC brands that are expected to be launched this year. DisplaySearch expects slates to take some market share from clamshell-style netbook PCs, as well as lure customers that desire more functionality away from the e-reader market. The company also foresees the majority of slate volume to ship into the North American and Western European markets due, in large part, to Apple’s distribution plans and known content agreements.

The mini-note/netbook/slate category will be the fastest-growing segment of the portable PC market for 2010, propelled in part by the introduction of slates. However, clamshell style devices will continue to grow as well. In addition, we expect continued strong growth in emerging markets and a recovery of B2B spending in the second half of the year to lead to 25.7% Y/Y growth as the market surges towards 215 million units.

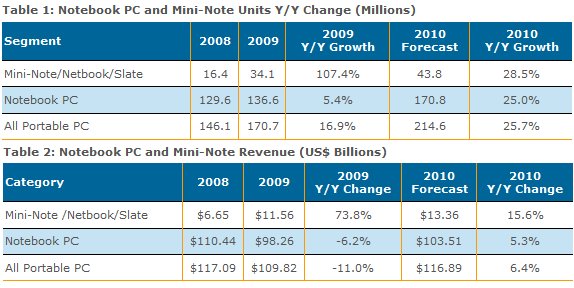

Strong unit growth and less ASP erosion in 2010 will combine to grow portable PC market revenue to almost $117 billion, recovering to 2008 levels. Revenue growth is forecast to be strongest in the mini-note/slate category due to the introduction of higher-priced products. ASPs for mini-notes have steadily eroded from $400 down to just under $300. The Apple iPad, which we expect to represent the bulk of slate shipments in 2010, has ASPs that start at $499 and increase to more than $800.

The low prices of clamshell-style mini-notes made these products attractive to buyers seeking a secondary or tertiary PC for the home or office, and also lowered the entry barrier for first-time PC buyers in emerging markets.

“We expect that, like Apple’s iPad, slates from other brands will be positioned as content consumption and manipulation devices, and the necessity of focusing on industrial design and features will result in ASPs that are higher than those of mini-notes,” notes John Jacobs, Director of Notebook Market Research.

Jacobs added, “The low ASPs of mini-notes have been a concern to component suppliers, OEMs/ODMs, brands and retailers, due to the thinner margins and lower revenue generation of the devices. Slates—especially those that will be able to mimic Apple’s content library, model of content delivery, and their very successful App Store—will be able to generate greater revenue and healthier margins for the brands that build them, the retailers that sell them, and many of the component makes in the supply chain.”