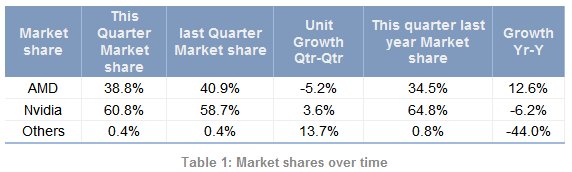

NVIDIA captured 60.8 percent of the discrete GPU market in Q4 2010, a gain of 2.1 percent vs Q3 2010, while AMD lost the same amount of marketshare. Here's the PR:

Jon Peddie Research (JPR), the industry's research and consulting firm for graphics and multimedia, announced estimated graphics Add-In Board (AIB) shipments and sales' market share for Q4'10.

Overall shipments of graphics AIBs for the year, 2010 came in lower than the recession year 2009 at 72.8 million units compared to 75.3 million for 2009 - a disappointing result given the enthusiastic start of the year. Shipments in Q4 2010 did not exceed Q3 as expected. Nvidia increased its shipments by 4.1% from Q3, while AMD declined -4.8% for the same period.

And in terms of market share, market leader Nvidia increased its share by 3.6% from Q3, while AMD's market share declined -5.2% for the same period. On a year-to-year basis AMD increased its market share by 12.6% while Nvidia lost 6.2% of market share.

The AIB market is fueled at the high-end by the gamer, small in volume (~3m a year) but high in dollars (average spend for an AIB ~$300.) The volume comes from the mainstream. And GPU-compute is adding to sales on the high end. The workstation market is about the same size as the gamer, but much it is characterized by higher average selling prices (ASPs).

For the year the AIB market hit $17.2 billion, up 0.8% from 2009 showing a gradual rise in ASP.

The decline in unit shipments of desktop AIBs is due to two factors - the erosion of the low end (Value segment) by the Integrated Processor Units (IGPs) and embedded CPU graphics (e.g., AMD's Fusion, and Intel's Clarkstown), and the shift in market share to notebooks, laptops, and tablet. However, that is being somewhat offset by the increase in sales of AIBs for GPU-compute, and by the use of two or more AIBs in high-end gaming and workstation systems.