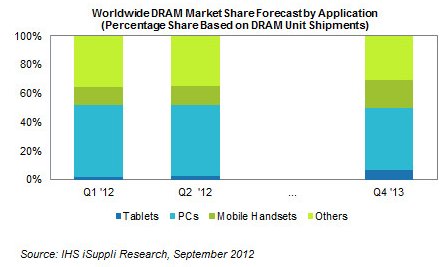

DRAM demand from tablets is now at 2.7 percent, up from 1.6 percent in Q1 2012, and is anticipated to reach 6.9 percent in Q4 2013. Smartphones are another fast-growing segment, their DRAM demand is anticipated to hit 26.7 percent in Q4 2013, nearly double from 14.1 percent in Q1 2012.

Another large part of the market is thrown together in a big "others" category, this includes consumer electronics like set-top boxes, LCD TVs, and digital cameras.

Here's the full press release from IHS iSuppli:

In a significant changing of the guard that also reflects the growing dominion of media tablets like the iPad from Apple Inc., PCs during the second quarter accounted for less than half of the market for dynamic random access memory (DRAM)—the first time that share by traditionally the strongest consumer of the memory type fell below 50 percent, according to an IHS iSuppli DRAM Dynamics brief from information and analytics provider IHS.

PCs in the second quarter made up 49.0 percent of the DRAM market in terms of bit shipments, down from 50.2 percent in the earlier quarter. The fall is notable, especially as PC share has never dipped below 50 percent, even in the last two quarters prior to the second when the portion commanded by desktops, notebooks and netbooks combined seemed perilously close to ceding half of the DRAM space. Average PC share from the first quarter of 2008 until the fourth quarter of 2011 hovered at approximately 55 percent, with share fluctuating periodically but generally trending down.

And while overall DRAM bit shipments for PCs continue to grow, the decline in DRAM share for PCs appears irreversible. From the second quarter this year to the fourth quarter in 2013, the portion for PCs will contract by another 6 percentage points, sliding to 42.8 percent.

In comparison, the share of tablets will continue to rise. Tablet share of the DRAM space in bit shipments grew to 2.7 percent in the second quarter, up from 1.6 percent in the first quarter, and will gradually expand by 4 percentage points until it hits 6.9 percent by the fourth quarter next year.

Worldwide DRAM Market Share Forecast

Only cellphones, increasing by approximately 7 percentage points during the equivalent period, will have greater growth in DRAM market share among devices. And together, mobile handsets and tablets present a formidable challenge to PCs. The combined share in the fourth quarter of 2013 by handsets and tablets of the DRAM market will reach 26.7 percent—nearly double from 14.1 percent in the first quarter this year.

Besides PCs, mobile handsets and tablets, DRAM is also used in items like set-top boxes, liquid crystal display televisions and digital still cameras—devices that altogether account for approximately one-third in bit shipments of the DRAM market.

Tablets rule as consumers overlook the PC

The expansion in DRAM market share for tablets is a result of the sheer growth in tablet shipments, which has come at tremendous expense to PCs, a traditional DRAM stronghold. For instance, tablet shipments will grow 24 percent in the third quarter and then by 55 percent in the fourth quarter. Laptop shipments, meanwhile, are expected to increase by just 9 and 12 percent, respectively, during the same two periods.

Tablets have been growing in popularity since the iPad was introduced in 2010 at the cost of PCs, especially notebooks, with tablets being regarded as acceptable PC complements or substitutes. And despite economic uncertainties worldwide, the tablet market continues to enjoy bright prospects ahead—in part because of the ease of use and portability of the devices, and also because of the “wow” factor associated with them.

The growing share of tablets in the DRAM market can likewise be attributed to more DRAM bits being loaded onto the devices. The third-generation new iPad has double the DRAM content of its predecessor, with up to 1024 megabytes—or more than 1 gigabyte—compared to 512 megabytes in the iPad 2. The additional DRAM in the new iPad brings it in line with direct competitors such as the Galaxy Tab 7.7 LTE from Samsung Electronics and the Jetstream from HTC, both of which also contain 1024 megabytes of DRAM. Among tablet devices, the Amazon Kindle Fire is the only tablet with less than 1 gigabyte, but the Kindle Fire is not competing directly with the more powerful tablet devices.

The difference in DRAM loading for tablets is because, unlike smartphones—in which memory configurations are converging into an unofficial standard—the use of memory in tablets is more diverse, especially in NAND flash loading. While some manufacturers are focused on making tablets that are as powerful as laptops, others—like Amazon—are looking toward a less powerful solution, such as one that embodies the function of an ereader coupled with an Internet browser. As a result, tablets have more room and flexibility where DRAM loading is concerned.

Like the solid quarterly results, the long-term trend for DRAM in tablets is equally encouraging. Rapid growth continues despite some deceleration in market share expansion for tablets, reaching a 9 percent rate of increase by 2016.

DRAM loading in tablets is also solid for the years ahead, reaching 2 gigabytes by 2015 after DRAM loading growth of 79 percent this year, and then tapering to a still-elevated 30 to 40 percent expansion rate from 2013 to 2016.