Posted on Friday, March 01 2013 @ 12:41 CET by Thomas De Maesschalck

A new report by

DisplaySearch indicates demand for large tablets is shrinking as the market is shifting towards smaller screen sizes.

The launch of the iPad mini in late 2012 has been seen as an acknowledgement by Apple that smaller size (7-9”) tablet PCs would become a larger part of the market than larger sizes (9.7” or 10.1”). Key aspects are more attractive prices and the ability to hold the device in one hand rather than two. Data published in the latest Monthly TFT LCD Shipment Database indicate that in the first month of 2013, tablet PC panel shipments shifted dramatically toward smaller screen sizes.

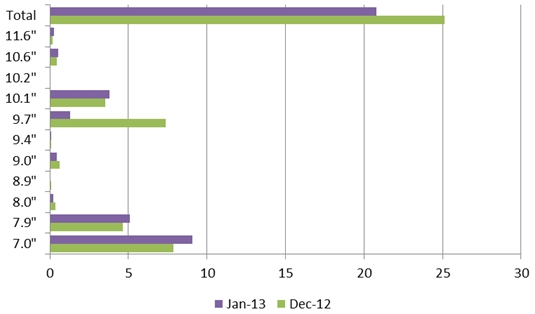

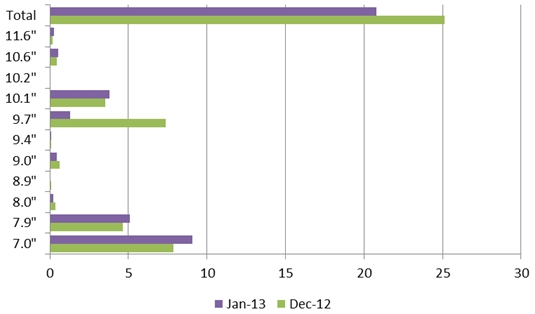

Shipments of 9.7”tablet PC panels collapsed, falling from 7.4 to 1.3M, while 7”and 7.9”panel shipments grew rapidly, from 12 to 14M. Shipments of 10.1”panels grew only slightly. The January panel shipment data may be an indicator for 2013, starting with Apple’s product mix shift. As we noted in December, Apple had planned to sell 40M iPad minis (7.9”) and 60M iPads (9.7”) in 2013. However, the reality seems to be the reverse, as the iPad mini has been more popular than the iPad. We now understand that Apple may be planning to sell 55M iPad minis (7.9”) and 33M iPads (9.7”) in 2013. At the same time, Samsung, Amazon, Google, ASUS and Acer are all eyeing the 7-9” segment to grab tablet PC market share, while many white box makers in China are also emphasizing the smaller size tablet PC.

In the Quarterly Worldwide FPD Shipment and Forecast Report, we forecast that tablet PC panels will hit 254M in 2013, up tremendously from 160M in 2012. Of this, 5-8.9” panels will account for 136M and 9-10” for 118M. That means smaller size tablet PC panels (7-8.9”) will surpass the larger size tablet PC panels (9-10”+). However, there will be some key issues as the 7-9” segment grows rapidly:

How will 7.x” tablet PCs be influenced by 5-6” smart phone sales? As the smart phone moves to larger sizes such as 5-6”, “phablets” – converged smart phone and tablet PC devices – could cannibalize the 7” tablet PC market.

Will the next resolution upgrade for 7.85” be UXGA (1920 × 1200, more than 250 ppi) or QXGA (2048 × 1536, more than 300 ppi)? Apple had been leading the trend towards high resolution, stimulating others to change their product plans.

Many panel makers are developing 7” 1920 × 1200 or even 8.9” 1920 × 1200 or 2048 × 1536 panels with more than 300 ppi. However, there will be challenges for a smooth panel supply. There are three technology choices for such high resolution in the 7-9” segment: a-Si, LTPS, and oxide. Every panel maker has a different strategy. What will be the mainstream?

Due to the popularity of the iPad mini’s slim bezel, slim bezels with thin panel frames have become important in the tablet PC market. Some panel makers believe that LTPS, with the driver IC integrated (which is called GOA, or gate on array) is the only way to achieve a slim bezel. Others see LTPS as the only solution for QXGA resolution of 330 ppi with a slim bezel. However, the yield rate and huge investment of LTPS remain question marks.

Until now, 7-9” tablet PC purchases are mainly due to the comparatively lower price point. However, this is not a long-term solution for brands. With upgrades in resolution, function, and product design, can 7-9” tablet PCs move to a more premium positioning, targeting users willing to pay a premium for a high-end product even if it is smaller?