Posted on Monday, May 20 2013 @ 19:04 CEST by Thomas De Maesschalck

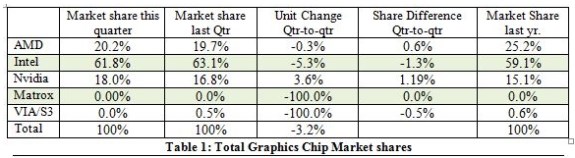

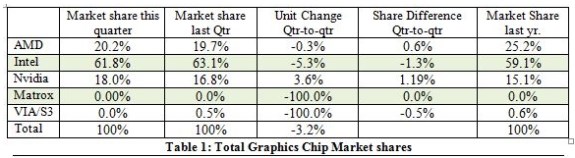

Jon Peddie Research published its Q1 2013 GPU market report. The research firm notes AMD and NVIDIA saw their share of the GPU market increase, while Intel saw its share drop from 63.1 percent to 61.8 percent quarter-over-quarter.

Jon Peddie Research (JPR), the industry's research and consulting firm for graphics and multimedia, announced estimated graphics chip shipments and suppliers’ market share for 2013 Q1.

The news was disappointing for Intel, but encouraging for Nvidia and for AMD on the desktop.

AMD lost 0.3%, quarter-to-quarter, Intel slipped 5.3%, and Nvidia increased by 3.6%.

The overall PC market declined 13.7% quarter-to-quarter while the graphics market only declined 3.2% reflecting an interest on the part of consumers for double-attach—the adding of a discrete GPU to a system with integrated processor graphics.

On a year-to-year basis we found that total graphics shipments during Q1’13 dropped 12.9% similar to PCs shipments declined by 12.6% overall. GPUs are traditionally a leading indicator of the market, since a GPU goes into every system before it is shipped and most of the PC vendors are guiding down to flat for Q2’13.

The popularity of tablets and the persistent economic malaise are the most often mentioned reasons for the altered nature of the PC market. Nonetheless, the CAGR for PC graphics from 2012 to 2016 is 2.6%, and we expect the total shipments of graphics chips in 2016 to be 394 million units.

The ten-year average change for graphics shipments for quarter-to-quarter is a growth of -2.2%. This quarter is below the average with a 3.2% decrease.

Our findings include discrete and integrated graphics (CPU and chipset) for Desktops, Notebooks (and Netbooks), and PC-based commercial (i.e., POS) and industrial/scientific and embedded. This report does not include handhelds (i.e., mobile phones), x86 Servers or ARM-based Tablets (i.e. iPad and Android-based Tablets), Smartbooks, or ARM-based Servers. It does include x86-based tablets.

The quarter in general

AMD’s quarter-to-quarter total shipments of desktop heterogeneous GPU/CPUs, i.e., APUs jumped 30% from Q4 and declined 7.3% in notebooks. The company’s overall PC graphics shipments slipped 0.3%.

Intel’s quarter-to-quarter desktop processor-graphics EPG shipments decreased from last quarter by 3%, and Notebooks fell by 6.3%. The company’s overall PC graphics shipments dropped 5.3%.

Nvidia’s quarter-to-quarter desktop discrete shipments were flat from last quarter; and, the company’s mobile discrete shipments increased 7.6%. The company’s overall PC graphics shipments increase 3.6%.

Year to year this quarter AMD shipments declined 29.4%, Intel dropped 8.8%, Nvidia increased 3.6%, and VIA fell 8.4% from last year.

Total discrete GPUs (desktop and notebook) were up 1.1% from the last quarter and were down 11% from last year for the same quarter due to the same problems plaguing the overall PC industry. Overall the trend for discrete GPUs is up with a CAGR to 2016 of 2.6%.

Ninety nine percent of Intel’s non-server processors have graphics, and over 67% of AMD’s non-server processors contain integrated graphics; AMD still ships IGPs.

Year to year for the quarter the graphics market decreased. Shipments were down 15.8 million units from this quarter last year.

Graphics chips (GPUs) and chips with graphics (IGPs, APUs, and EPGs) are a leading indicator for the PC market. At least one and often two GPUs are present in every PC shipped. It can take the form of a discrete chip, a GPU integrated in the chipset or embedded in the CPU. The average has grown from 1.2 GPUs per PC in 2001 to almost 1.4 GPUs per PC.