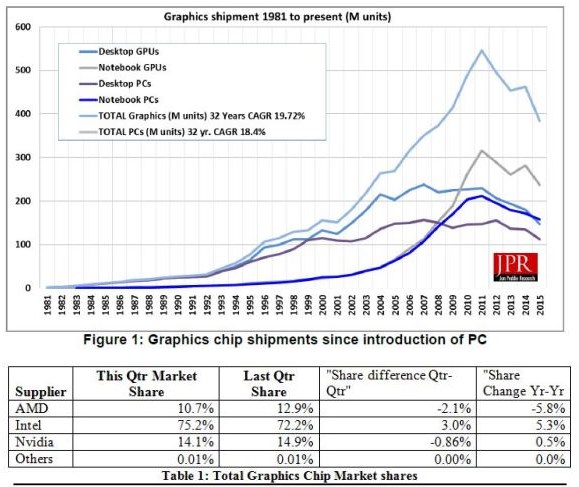

AMD was hit hardest as it saw its total graphics shipments decline by 25.82 percent quarter-over-quarter, followed by NVIDIA with a 16.19 percent decline and Intel with a 7.39 percent decline. Intel managed to increase its marketshare from 72.2 percent in Q1 2015 to 75.2 percent in Q2 2015, while AMD's marketshare fell from 12.9 percent to 10.7 percent in the same timeframe. NVIDIA's marketshare dropped from 14.9 percent to 14.1 percent.

Overall PC sales were down 4.05 percent quarter-over-quarter and just 26.43 percent of new PCs had discrete GPUs, a drop of 4.15 percent. Sales of discrete video cards for the desktop market were down 16.81 percent from last quarter and total discrete GPU (desktop and laptop) shipments decreased 17.07 percent from Q2 2015, a 26.27 percent year-over-year decline.

Looking at the quarter-over-quarter numbers in more detail, AMD reportedly shipped 25 percent more desktop APUs but saw its laptop APU sales collapse by 53.5 percent. AMD's discrete graphics card sales were hit by a 33.33 percent slide in sales, while sales of discrete video cards for the laptop market fell 9.1 percent.

Intel's desktop processors with integrated graphics saw a 7.4 percent shipment decline while the notebook counterparts fell 7.3 percent.

NVIDIA's desktop graphics card sales were down 12.03 percent while its notebook video card sales collapsed 21.6 percent. Soon Jon Peddie research will publish its discrete graphics card market research report but from the figures of the overall graphics card market it's already clear that AMD's discrete video card marketshare is becoming dangerously low.

Here's the full PR from JPR:

Discrete GPUs continue to slip as embedded GPUs in the CPU and APU bring better performance for free. The erosion of the low end of the market by tablets seems to have subsided, and even tablet sales were off for the second quarter in a row.

Graphics processors, stand-alone discrete devices, and embedded processor-based GPUs are ubiquitous and essential components in all systems and device today from handheld mobile devices, PCs, and workstations, to TVs, servers, vehicle systems, signage, game consoles, medical equipment, and wearables. New technologies and semiconductor manufacturing processes are taking advantage of the ability of GPU power to scale. The GPU drives the screen of every device we encounter—it is the humane-machine interface.

We have just released a new report on the GPUs found in PCs.

The second quarter is typically down in the seasonality cycles of the past and was below the ten-year average of 6.86%.

Quick highlights:

AMD’s overall unit shipments decreased -25.82% quarter-to-quarter, Intel’s total shipments decreased -7.39% from last quarter, and Nvidia’s decreased -16.19%. The attach rate of GPUs (includes integrated and discrete GPUs) to PCs for the quarter was 137% which was down -10.82% from last quarter, and 26.43% of PCs had discrete GPUs, which is down -4.15%. The overall PC market decreased -4.05% quarter-to-quarter, and decreased -10.40% year-to-year. Desktop graphics add-in boards (AIBs) that use discrete GPUs decreased -16.81% from last quarter.

The second quarter is typically a down quarter as OEMs and the channel clear out older inventory, and get ready for the fall back to school and holiday sales season.

GPUs are traditionally a leading indicator of the market, since a GPU goes into every system before it is shipped, and, however, most of the PC vendors are guiding cautiously for Q3’15.

Q2 2015 saw the second quarter in a row of a decline in tablets sales. The CAGR for total PC graphics from 2014 to 2017 is down, to -6.1%. We expect the total shipments of graphics chips in 2017 to be 383 million units. down from the peak of 545 inn 2011.

The quarter in general

AMD’s shipments of desktop heterogeneous GPU/CPUs, i.e., APUs, increased 25.0% from the previous quarter, and were down -53.5% in notebooks. AMD’s discrete desktop shipments decreased -33.33% from last quarter, and notebook discrete shipments decreased -9.1%. The company’s overall PC graphics shipments decreased -25.8% from the previous quarter.

Intel’s desktop processor embedded graphics (EPGs) shipments decreased from last quarter by -7.4%, and notebooks decreased by -7.3%. The company’s overall PC graphics shipments decreased -7.4% from last quarter.

Nvidia’s desktop discrete shipments were down -12.03% from last quarter; and the company’s notebook discrete shipments decreased -21.6%. The company’s overall PC graphics shipment decreased -16.2% from last quarter. The company saw strength in gaming from Western Europe and China which helped it buck a down quarter for the industry.

Total discrete GPU (desktop and notebook) shipments from the last quarter decreased -17.07% and decreased -26.27% from last year. Sales of discrete GPUs fluctuate due to a variety of factors (timing, memory pricing, etc.), new product introductions, and the influence of integrated graphics. Overall, the CAGR from 2014 to 2017 is now -6%.

Ninety nine percent of Intel’s non-server processors have graphics, and over 66% of AMD’s non-server processors contain integrated graphics; AMD still ships integrated graphics chipsets (IGPs).

Because Graphics chips (GPUs) and chips with graphics (IGPs, APUs, and EPGs) GPUs shipments are a leading indicator for the PC market. At least one and often two GPUs are present in every PC shipped. It can take the form of a discrete chip, a GPU integrated in the chipset or embedded in the CPU. The average has grown from 1.2 GPUs per PC in 2001 to almost 1.55 GPUs per PC.