The first big conclusion from the report is that shipments of video cards were up massively. The add-in board graphics card market rose 29.1 percent versus Q2 2017, and was up 21.5 percent year-over-year.

Interestingly, Jon Peddie believes cryptocurrency was not as big an influence this quarter as it was in the previous quarter. It provided a boost to sales but PC gaming is still gaining momentum as there are a lot of great games coming out, and eSports is also going strong.

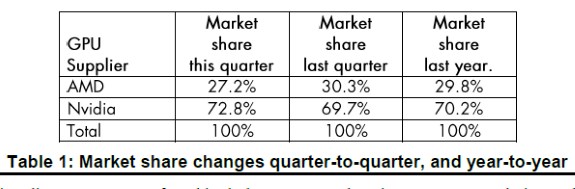

While video card sales were up a lot, it's interesting to see that NVIDIA manged to capture quite a lot of marketshare last quarter. It seems AMD's Radeon RX Vega launch may not have had the desired effect. AMD saw its marketshare decline from 30.3 percent in Q2 2017 to 27.2 percent in Q3 2017. NVIDIA on the other hand saw its share rise from 69.7 percent to 72.8 percent.

“The add-in graphics board market was outstanding in Q3'17, increasing 29.1% sequentially, explained Jon Peddie, president of the industry’s research consulting firm Jon Peddie Research. The seasonal ten-year average for Q3 is 14%, and this year it was over twice that.”

The market shares for the desktop discrete GPU suppliers shifted in the quarter too.

AIBs using discrete GPUs are found in desktop PCs, workstations, servers, rendering and mining farms, and other devices such as scientific instruments. They are sold directly to customers as aftermarket products, or are factory installed by OEMs. In all cases, AIBs represent the higher end of the graphics industry with their discrete chips and private, often large, high-speed memory, as compared to the integrated GPUs in CPUs that share slower system memory.

The PC add-in board (AIB) market now has just two chip (GPU) suppliers which also build and sell AIBs. The primary suppliers of GPUs are AMD and Nvidia. There are 48 AIB suppliers, the AIB OEM customers of the GPU suppliers, which they call “partners.”

Lots of AIB suppliers, smaller shipments. In addition to privately branded AIBs offered worldwide, about a dozen PC suppliers offer AIBs as part of a system, and/or as an option, and some that offer AIBs as separate aftermarket products. We have been tracking AIB shipments quarterly since 1987—the volume of those boards peaked in 1999, reaching 114 million units, in 2016, 47 million shipped.

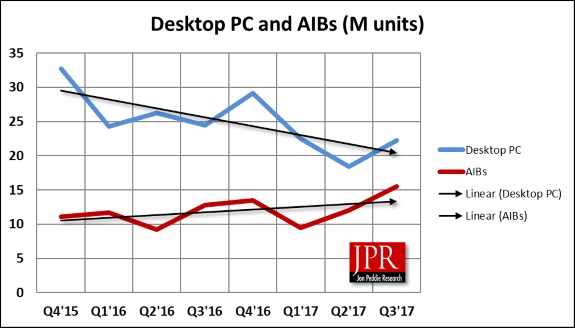

The news for the quarter was encouraging and seasonally understandable, quarter-to-quarter, the AIB market increased 29.1% (compared to the desktop PC market, which increased 21.2%).

The GPU and PC market have been showing a return to normal seasonality. That pattern is typically flat to down in Q1, a significant drop in Q2 as OEMs and the channel deplete inventory before the summer months. A restocking with the latest products in Q3 in anticipation of the holiday season, and mild increase to flat change in Q4. All, of that subject to an overall decline in the PC market since the great recession of ’07 and the influx of tablets and smartphones. However, this year, AIB shipments were out of synch due to great new games and cryptocurrency mining.

AIB shipments during the quarter increased from the last quarter 29.1%, which is which is above the ten-year average of 14.4%. On a year-to-year basis, we found that total AIB shipments during the quarter rose 21.5%, which is greater than desktop PCs, which fell 8.9%.

Cryptocurrency mining was not as big influence in the AIB market this quarter as it was in the lat. Nonetheless, cryptocurrency mining (especially Ethereum) is still a factor in the market, and still just as impossible to accurately measure.

Gaming the game changer. However, despite the overall PC churn, somewhat due to tablets and embedded graphics, the PC gaming momentum continues to build and is the bright spot in the AIB market. The impact and influence of eSports has also contributed to the market growth and attracted new users. VR continues to be interesting but is not having a measurable influence on the AIB market.

The gaming PC (system) market is as vibrant as the stand alone AIB market. All OEMs are investing in gaming space because demand for gaming PCs is robust. AMD introduced their Threadripper CPU targeted at the high-end gaming market, and Intel also validated this with their recent announcement of a new Enthusiast CPU. Furthermore, desktop gaming PCs are no longer dwarfed by the general-purpose machines. That’s not the case in the notebook market

Looking at the above chart, the seasonally cycle has been re-established, suggesting Q4 will be flat to down, and the semiconductor suppliers and OEMs are forecasting a flat to down Q4. The swings are more dramatic now, as can be seen in quarter-to-quarter changes.

The overall GPU shipments (integrated and discrete) is greater than desktop PC shipments due double-attach—the adding of an AIB to a system with integrated processor graphics, or a second AIB using either AMD’s Crossfire or Nvidia’s SLI technology.

Improved attach rate. The attach rate of AIBs in desktop PCs has declined from a peak of 84% in 2002 to a low of 36% in 2015, and steadily increased since then to 70% this quarter, a increase of 6.5% from last quarter which was nominal. Compared to this quarter last year it increased 33.3% which was outstanding.

The gaming PC (system) market is as vibrant as the stand alone AIB market. All OEMs are investing in Gaming space because demand for Gaming PCs is robust. AMD and Intel also validated this on their earnings calls, and the recent announcements of a new Enthusiast CPUs.