Posted on Thursday, August 30 2018 @ 16:52 CEST by Thomas De Maesschalck

Jon Peddie Research offers the highlights from its Q2 2018 graphics chip report. Compared with a year ago, overall GPU shipments were down 4.9 percent. The report mentions that add-in board GPU shipments decreased 27.96 percent versus the quarter before, in large part due to the bust of the cryptocurrency markets. Versus the previous quarter, shipments were down 1.5 percent. AMD was hit hardest, with a 12.3 percent quarter-over-quarter decline, while NVIDIA decreased 7.0 percent. The firm's report about the discrete video card market will follow next month.

Jon Peddie Research, the industry’s market research firm for the graphics industry, has released its quarterly Market Watch report.

This is the latest report from Jon Peddie Research on the GPUs used in PCs. It is reporting on the results of Q2'18 GPU shipments worldwide.

Overall GPU shipments decreased -1.5% from last quarter, AMD decreased -12.3%, Nvidia decreased -7% and Intel, increased 3%.

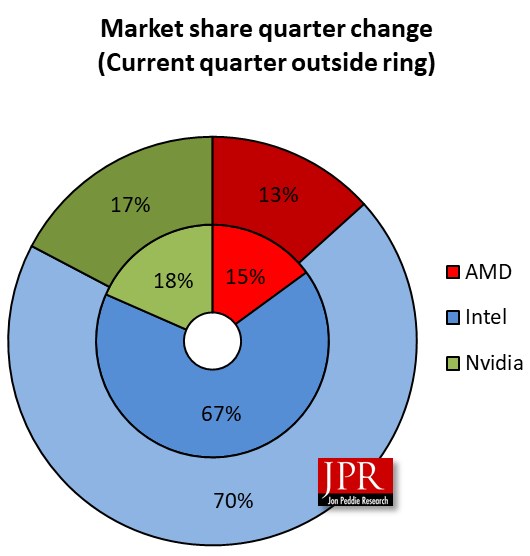

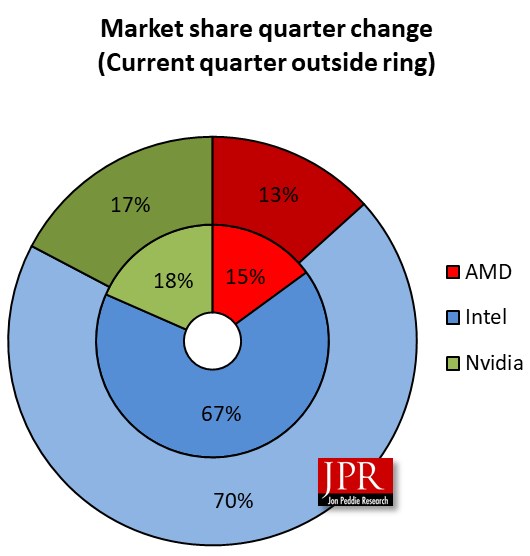

The market share for total GPU shipments in the quarter, compared to last quarter is shown in the following chart.

Quick highlights

AMD’s overall unit shipments decreased -12.28% quarter-to-quarter, Intel’s total shipments increased 2.62% from last quarter, and Nvidia’s decreased -7.49%.

The attach rate of GPUs (includes integrated and discrete GPUs) to PCs for the quarter was 135% which was down -4.61% from last quarter.

Discrete GPUs were in 32.83% of PCs, down -6.28%.

The overall PC market increased 1.9% quarter-to-quarter and increased 2.04% year-to-year.

Desktop graphics add-in boards (AIBs) that use discrete GPUs decreased -27.96% from last quarter.

Q2'18 saw a no change in tablet shipments from last quarter.

Our findings include discrete and integrated graphics (CPU and chipset) for Desktops, Notebooks (and Netbooks). It does not include iPad and Android-based tablets, or ARM-based servers, or x86-based servers. It does include x86-based tablets, Chromebooks, and embedded systems.

GPUs are traditionally a leading indicator of the market, since a GPU goes into every non-server system before it is shipped, and most of the PC vendors are guiding cautiously for Q2’18 The Gaming PC segment, where higher end GPUs are used, was a bright spot in the market in the quarter.

Market share for total GPUs for the quarter

Market shares shifted for the big three, and put pressure on the smaller two, market share in shipments as indicated in the Table (units are in millions).

Year-to-year total GPU shipments decreased -4.9%, desktop graphics decreased -6%, notebooks decreased -5%.

The PC market is showing more stabilization, and now seems to have shaken off the gold rush fever of crypto-mining, overall volume slipped, albeit with bright spots for the market here and there.

We can mark Q1’18 as the peak and last hurrah of the crypto-mining fever. Desktop GPUs, which went into mining rigs, have dropped back to their normal volume.

We believe the market for AIBs for crypto-mining has ended and this will likely be our last mention of it.

Tablets too have seen a slowdown from their peak in 2014, and the forecast is that this once PC cannibal has saturated its market and will decline to a replacement status. It will also be in turn cannibalized by the smart new always connected detachable PC tablets.

The second quarter is typically down from the previous quarter in the seasonal cycles of the past. For Q2'18 it decreased -1.5% from last quarter and was below the ten-year average of -2.99%.