The firm's shares got hit pretty hard and are currently down 16.37 percent in after-hours trading, to a level of $169.26. The culprit is the weak guidance, NVIDIA estimates fourth-quarter revenue of $2.7 billion plus or minus 2 percent, which is way below analyst estimates of $3.4 billion. NVIDIA claims the near-term results reflect the fallout from the bust of the cryptocurrency boom, which resulted in excess channel inventory.

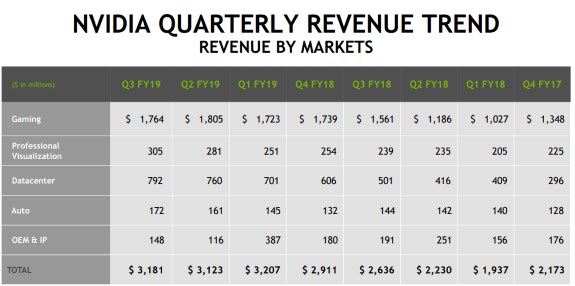

NVIDIA (NASDAQ: NVDA) today reported revenue for the third quarter ended Oct. 28, 2018, of $3.18 billion, up 21 percent from $2.64 billion a year earlier, and up 2 percent from $3.12 billion in the previous quarter.

GAAP earnings per diluted share for the quarter were $1.97, up 48 percent from $1.33 a year ago and up 12 percent from $1.76 in the previous quarter. Non-GAAP earnings per diluted share were $1.84, up 38 percent from $1.33 a year earlier and down 5 percent from $1.94 in the previous quarter.

“AI is advancing at an incredible pace across the world, driving record revenues for our datacenter platforms,” said Jensen Huang, founder and CEO of NVIDIA. “Our introduction of Turing GPUs is a giant leap for computer graphics and AI, bringing the magic of real-time ray tracing to games and the biggest generational performance improvements we have ever delivered.

“Our near-term results reflect excess channel inventory post the crypto-currency boom, which will be corrected. Our market position and growth opportunities are stronger than ever. During the quarter, we launched new platforms to extend our architecture into new growth markets – RAPIDS for machine learning, RTX Server for film rendering, and the T4 Cloud GPU for hyperscale and cloud.”

Capital Return

During the first nine months of fiscal 2019, NVIDIA returned $1.13 billion to shareholders through a combination of $855 million in share repurchases and $273 million in quarterly cash dividends.

In November 2018, the board of directors authorized an additional $7 billion under the company’s share repurchase program for a total of $7.94 billion available through the end of December 2022.

NVIDIA announced a 7 percent increase in its quarterly cash dividend to $0.16 per share from $0.15 per share, to be paid with its next quarterly cash dividend on December 21, 2018, to all shareholders of record on November 30, 2018.

NVIDIA intends to return an additional $3 billion to shareholders by the end of fiscal 2020, which may begin in the fourth quarter of fiscal 2019.

NVIDIA’s outlook for the fourth quarter of fiscal 2019 is as follows:

Revenue is expected to be $2.70 billion, plus or minus 2 percent.

GAAP and non-GAAP gross margins are expected to be 62.3 percent and 62.5 percent, respectively, plus or minus 50 basis points.

GAAP and non-GAAP operating expenses are expected to be approximately $915 million and $755 million, respectively.

GAAP and non-GAAP other income and expense are both expected to be income of approximately $21 million.

GAAP and non-GAAP tax rates are both expected to be 8 percent, plus or minus 1 percent, excluding any discrete items. GAAP discrete items include excess tax benefits or deficiencies related to stock-based compensation, which are expected to generate variability on a quarter by quarter basis.