Posted on Monday, February 17 2020 @ 12:12 CET by Thomas De Maesschalck

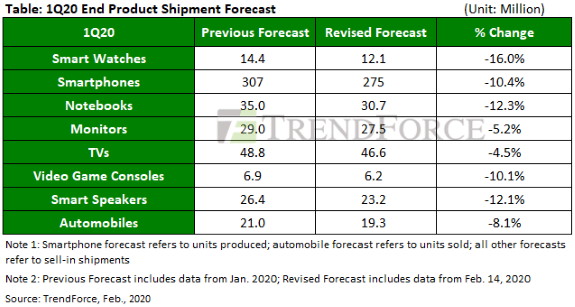

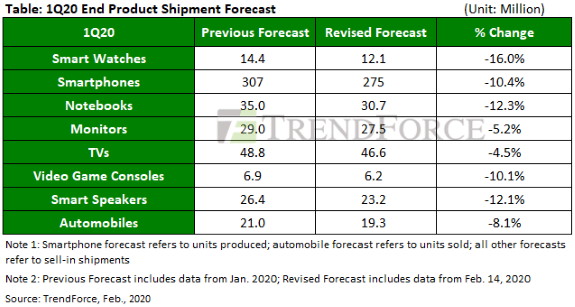

TrendForce issued a new report that estimates the impact of the noval coronavirus (COVID-19) outbreak on the production of high-tech products. Compared with the previous forecast, the production of most products is expected to take a hit of about 5.0 percent to as much as 16.0 percent this quarter. Detailed analysis for the segments listed below, as well as other markets like batteries, solar panels, LEDs, 5G, and more can be found

at TrendForce.

Memory Products

On the supply side, manufacturing operations of China-based DRAM and NAND flash production bases, such as Samsung’s Xi’an fab, SK Hynix’s Wuxi fab, YMTC, CXMT, and JHICC, are not affected by the outbreak, since semiconductor fabs are highly automated, with very low demands for manpower. In addition, companies stocked up on materials before Chinese New year, enough to avoid shortages in the short term. As long as additional materials that need to be imported can pass through customs as usual, the outbreak should not cause any problems for the DRAM and NAND flash industry. Finally, with regards to shipping, all semiconductor fabs in China hold national special licenses, which allow them to ship their products throughout domestic China, even as cities are under quarantine. From a global perspective, memory product suppliers do not reduce their manufacturing operations unless a global systems-wide risk were to occur. Furthermore, as client-side inventories are still showing shortages, the purchasing momentum of memory products will continue to hold up despite problems of labor and material shortages faced by downstream clients. Therefore, 1Q20 DRAM prices will continue its uptrend in spite of the outbreak.

On the demand side, the COVID-19 outbreak has not currently caused any obvious impact on overall server shipment, with only a possible two-week delay in PCB supply. Even so, because manufacturers already prepared extra inventory before Chinese New Year, the delay in PCB supply will cause limited impact on server shipment. Notably, the Chinese data center industry has benefitted from the outbreak. For instance, Tencent’s server demand grew due to the rising need of distance education, while ByteDance also saw increased server demand because of the increased usage of its web apps.