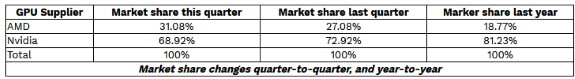

After losing a lot of marketshare to NVIDIA in recent years, AMD is climing out of the hole again and saw a big increase in marketshare in 2019. The firm held just 18.77 percent of the market in Q4 2018 but is now back at 31.08 percent. That compares to 27.08 percent in Q3 2019.

NVIDIA on the other hand now has 68.92 percent marketshare, down from 72.92 percent a quarter ago. The overall discrete GPU board market was up 33.4 percent year-over-year, to over $3.9 billion in sales in Q4 2019.

The add-in board market increased in Q4'19 from last quarter, and AMD gained market share. Over $3.9 billion dollars of AIBs shipped in the quarter.

Quarter-to-quarter graphics add-in board shipments increased significantly by 12.2% and increased by 33.4% year-to-year.

The market shares for the desktop discrete GPU suppliers shifted in the quarter too, AMD increased market share from last quarter, and AMD increased share from last year.

Jon Peddie, president of JPR noted, “this is the third consecutive quarter of increased AIB shipments, However, Q1 which is seasonally flat to down may show an unusual dip because of supply chain interruptions from China due to the Coronavirus epidemic. 2020 is going to be a game-changer with Intel’s entry into the discrete GPU market and a possible fourth entry by an IP company.”

Intel’s entry into the AIB market in 2020 will shift market share but not have an immediate influence on overall sales. However, we believe Intel’s brand is so powerful that new AIB customers will come into the market. Offsetting that will be the effect of streaming gaming from Google, Nvidia and others which may cause some gamers to delay buying a new AIB.

GPUs are traditionally a leading indicator of the market since a GPU goes into every system before the suppliers' ships the PC. Most of the semiconductor vendors are guiding down for next quarter, by an average of -9%. Some that guidance is based on normal seasonality, but there is also a factor for the Coronavirus impact.

Add-in boards (AIBs) using discrete GPUs are found in desktop PCs, workstations, servers, rendering and mining farms, and other devices such as scientific instruments. They are sold directly to customers as aftermarket products, or are factory installed by OEMs. In all cases, AIBs represent the higher end of the graphics industry with their discrete chips and dedicated, often large, high-speed memory. Systems with integrated GPUs in CPUs share slower system memory.

The AIB market hit $16.1 billion last year and is forecasted to be $16.3 billion by 2023.

Since 1981, 1,303 million AIBs have been shipped.

The fourth quarter is normally flat to up from the previous quarter. This quarter it was up 12.2% from the last quarter. That is above the ten-year average of -2.3% which is unusually high when compared to the desktop PC market, which increased 22.4% from the last quarter.

On a year-to-year basis, we found that total AIB shipments during the quarter rose 6.2%, which is greater than desktop PCs, which fell -15.9% from the same quarter a year ago.

Overall, AIB shipments had been declining slightly, but not as much as the PC thanks to gamers upgrading their systems.

Similarly in 2015, when the use of AIB for cryptocurrency mining became widespread, AIB sales rose while PC sales fell.

Despite the overall PC churn, somewhat due to tablets and embedded graphics, the PC gaming momentum continues to be a bright spot in the AIB market. The impact and influence of eSports have also contributed to market growth and has attracted new users. VR continues to be interesting but is not having a measurable influence on the AIB market.