Posted on Monday, June 08 2020 @ 10:36 CEST by Thomas De Maesschalck

Jon Peddie Research published its report about the state graphics business in Q1 2020. This report covers the integrated plus discrete video card market. It reveals AMD and NVIDIA saw their unit shipments decline sequentially, while Intel saw a gain due to strong demand for its processors. The agency notes that the first quarter of the year is usually flat versus the previous quarter, but this quarter unit shipments were down significantly due to the COVID-19 pandemic.

As part of its ongoing research on the PC graphics market, Jon Peddie Research (JPR) has completed its Market Watch report for the first quarter of 2020. Before 2020, the PC market was showing signs of stabilizing into a new normal. JPR’s Market Watch report confirms that trend for the first quarter of 2020, for this very unusual year.

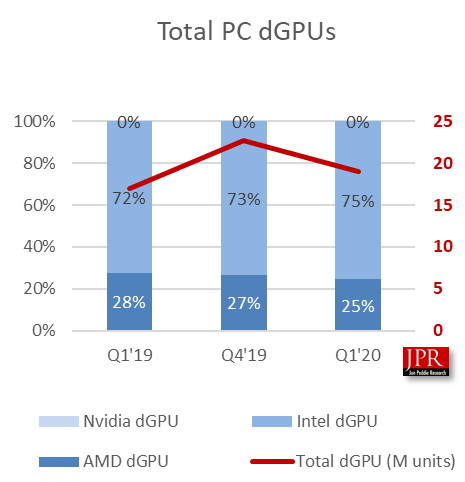

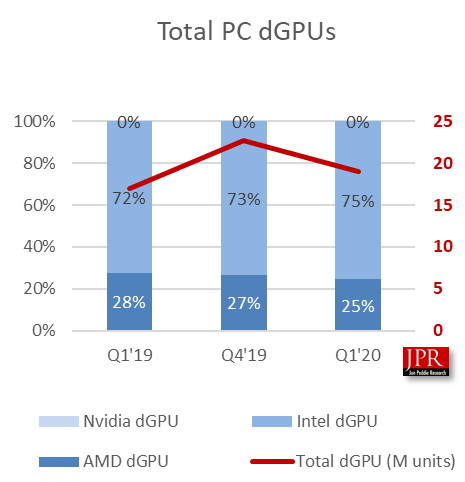

The three major players in the PC GPU market are AMD, Intel, and Nvidia. Overall GPU shipments decreased -5.3% from last quarter: AMD's shipments decreased -16.6%, Nvidia's shipments decreased -13.6%, and Intel's shipments increased 0.5%.

JPR continuously tracks market share for the PC GPU suppliers to create a picture of the competitive landscape. (More detail is provided in JPR’s Add-in-Board Report). AMD's market share from last quarter decreased -2.3%, Intel's market share increased 3.8%, and Nvidia's market share decreased -1.58%.

Quick highlights:

AMD’s overall unit shipments decreased by -16.6% quarter-to-quarter, Intel’s total shipments increased by 0.5% from last quarter, and Nvidia’s decreased -13.6%.

The overall attach rate of GPUs (includes integrated and discrete GPUs) to PCs for the quarter was 128% which was down -4.8% from last quarter.

The overall PC market decreased by -1.74% quarter-to-quarter and increased 15.53% year-to-year.

Desktop graphics add-in boards (AIBs that use discrete GPUs) decreased -19.53% from last quarter.

Q1'20 saw a decrease in tablet shipments from last quarter.

The first quarter is typically flat to down compared to the previous quarter. This quarter was down.

The above [below[ chart expresses total unit shipments (in red), and the platform share, as well as the current quarter, quarter-to-quarter results, and year-to-year quarter results.

Jon Peddie, President of JPR, notes “COVID-19 has been disruptive and had varying effects on the market. Some sales that might have occurred in Q3 (such as notebooks for the back-to-school season) have been pulled in to Q1 and probably will continue to sell well in Q2. That will unbalance the seasonality usually seen but not have a major impact on the overall sales for the year.

We believe the stay-at-home orders are creating pent up demand. Some of it will be offset due to the record-setting unemployment. Although unemployment will have a limited effect on many computer buyers, who may at least weather the early phases of the pandemic lockdowns and subsequent recession because their work lends itself to remote computing, consumer confidence is going to be impacted and jobs will be lost."

GPUs are traditionally a leading indicator of the market since a GPU goes into every system before the suppliers ship the PC, most of the semiconductor vendors are guiding down for next quarter, by an average of -9%. Some that guidance is based on normal seasonality, but there is also a factor for the Coronavirus impact.