Citing analyst reports, ExtremeTech writes average lead ties for chip deliveries are still getting worse. Before the pandemic, the average time between when an order was placed and the product got delivered to a warehouse was 12 weeks. In March, this figure was 16 weeks and in April it shot up to 17 weeks.

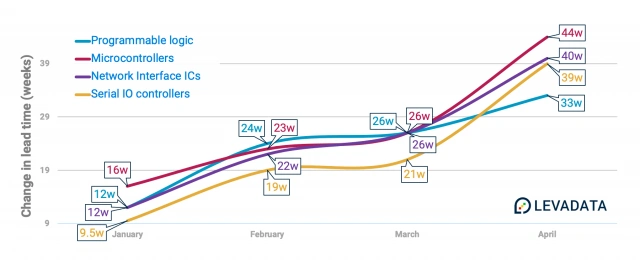

However, this industry-wide average masks the fact that some components are significantly more in short-supply than others. Power management circuitry for example is now seeing a 23.7-week lead time, up four weeks from March. Microcontrollers faced a 44-week lead time in April, significantly more than the 26-week lead time reported in March. Head phone components are even worse, with manufacturers suffering 52-week lead times!

A lot of these components are relatively cheap but have been very hard to find over the past six months. Lead times of some products has skyrocketed by 2x, 3x, or even more in some cases. In a lot of cases, it appears that not the major components, but the lack of small parts is the reason behind delays.

Hoarding increases the pain for everyone

ExtremeTech also highlights that the current market situation gets exacerbated by hoarding. The site points out car makers alone fear losing out on $110 billion in potential sales this year, primarily because they can't get parts that typically costs a couple of dollars (or less).The problem with these types of shortfalls, as we recently discussed in our own guide to Silicon Manufacturing in the Time of COVID-19 (working title), is that they encourage behavior like hoarding. A company that can’t ship a $50,000 final product due to a shortage of $5 parts has every reason on Earth to hoard and stockpile said parts, whether they actually need them or not.The following chart from LevaData shows the increase in lead time for several chip categories that are in severe short-supply:

The problem for foundries like TSMC is that it’s very difficult to tell real demand from hoarded product. The risk of a market overheat is rising, Rolland writes, due to the “bad behavior” shortages encourage. He warns that the semiconductor industry might be shipping more hardware than the actual level of customer demand can support. -- ExtremeTech