Compared with the previous quarter, shipments decline 0.3 percent. That's a lot better than usual, the typical seasonal trend of the past ten years has been a 7 percent decline in shipments. AMD's shipments declined 1.0 percent, Intel dropped 1.0 percent, and NVIDIA's shipments increased 3.9 percent.

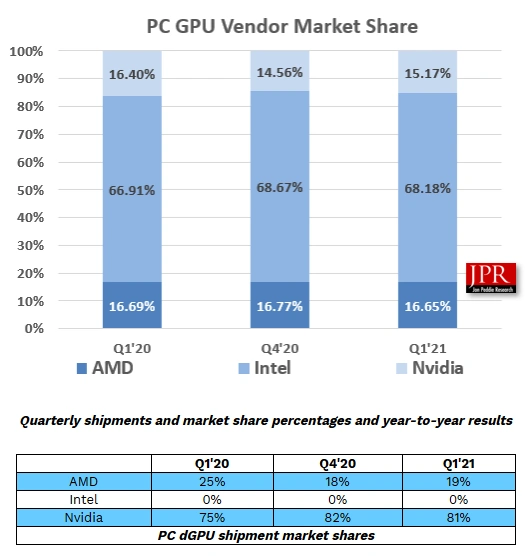

When zooming in on the discrete video card market, JPR found that compared with the previous quarter, AMD gained 1 percent marketshare, while NVIDIA dropped 1 percent. The latter now has 81 percent marketshare, while AMD holds the remaining 19 percent.

The elephant in the room -- cryptocurrencymining -- is not addressed by Jon Peddie Research's summary. I think this is one of the biggest questions right now, how much of the GPU supply is ending up in the hands of miners. There is no dancing around it, despite record numbers of GPUs shipping, gamers have been struggling to buy video cards for the best part of the past year.

According to a new research report from the analyst firm Jon Peddie Research, the growth of the PC-based Graphics Processor Units (GPU) market reached 119 million units in Q1'21 and 38.74% year-over-year. Overall, the installed base of GPUs will grow at a compound annual growth rate of 2.87% during 2020–2025 to reach a total of 3,333 million units at the end of the forecast period. Over the next five years, the penetration of discrete GPUs (dGPU) in the PC will grow to reach a level of 26%.

As part of its ongoing research on the PC graphics market, Jon Peddie Research (JPR) has released its Market Watch report for the first quarter of 2021. Before 2020, the PC market was showing signs of improvement and settling into a new normal. The weakness of the just-in-time supply-chain was revealed in 2020 and the manufacturers of semiconductors and other components have not been able to scale up to meet the surge in demand and the backlog that was created. Intel’s leading position in the market and their subsequent manufacturing difficulties exacerbated the situation. JPR’s Market Watch report confirms that trend for the first quarter of 2021, but with cautious guidance for the upcoming year.

AMD's overall market share percentage from last quarter decreased by -0.12%, Intel's market share decreased by -0.5%, and Nvidia's market share increased 0.62%, as indicated in the following chart.

Overall GPU unit shipments decreased by -0.3% from last quarter, AMD shipments decreased by -1.0%, Intel's shipments decreased by -1.0%, and Nvidia's shipments increased 3.9%.

Quick highlightsThe first quarter is typically flat to down compared to the previous quarter. This quarter was down. 0.3% from last quarter which is below the 10year average of 7%

- The GPU's overall attach rate (which includes integrated and discrete GPUs, desktop, notebook, and workstations) to PCs for the quarter was 117%, up 4% from last quarter.

- The overall PC CPU market decreased by -4% quarter-to-quarter and increased 39% year-to-year.

- Desktop graphics add-in boards (AIBs that use discrete GPUs) increased by 7% from the last quarter.

- This quarter saw no change in tablet shipments from last quarter.

GPUs are traditionally a leading indicator of the market since a GPU goes into every system before the suppliers ship the PC.

Due the rush to try and equip school children with Chromebooks, combined with the work-at-home rules due to the COVID-19 pandemic, notebook shipments exceeded 89 million units for the quarter—an all-time high. In addition, the year-to-year notebook growth was 49%, the greatest one-year growth on record—this in spite of disruptions in the supply chain. The forecast for Q2’21 is more modest, ~ 4%, but still higher than average. We expect to Chromebooks taper off in 2021 due to school budget limitations.

Jon Peddie, President of JPR, noted, “The risk is that semiconductor suppliers will be lured into over-reaction and believe that suddenly 100s of millions of new users have appeared and the demand will stay high. That’s not only not realistic, it’s also not true—where are they coming from—not this planet?”

Most of the semiconductor vendors are guiding up for the next quarter by an average of 3%. Some of that guidance is based on normal seasonality, but there is still a Coronavirus impact factor and a hangover in the supply-chain.

JPR also publishes a series of reports on the graphics Add-in-Board Market and PC Gaming Hardware Market, which covers the total market, including system and accessories, and looks at 31 countries.