Posted on Friday, August 27 2021 @ 17:16 CEST by Thomas De Maesschalck

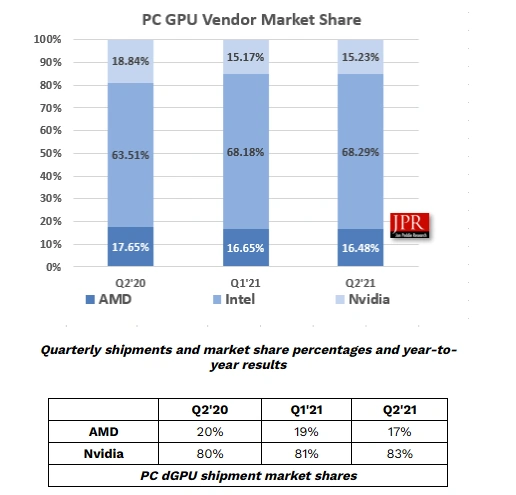

Jon Peddie Research issued a new report about the graphics market. The discrete video card marketshare statistics are the most interesting, of course. They reveal AMD lost quite a bit of marketshare to NVIDIA in Q2 2021. The latter now holds 83 percent of the market, as AMD fell from 19 percent in Q1 2021 to just 17 percent in Q2 2021.

Jon Peddie Research reports the growth of the global PC-based Graphics Processor Units (GPU) market reached 123 million units in Q2'21 and PC CPU shipments increased by 42% year-over-year. Overall, the installed base of GPUs will grow at a compound annual growth rate of 3.5% during 2020–2025 to reach a total of 3,318 million units at the end of the forecast period. Over the next five years, the penetration of discrete GPUs (dGPU) in the PC will grow to reach a level of 25%.

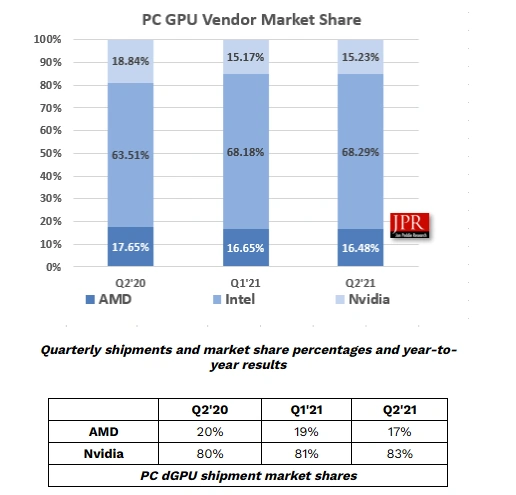

AMD's overall market share percentage from last quarter decreased by -0.2%, Intel's market share increased 0.1%, and Nvidia's market share increased 0.06%, as indicated in the following chart.

Overall GPU unit shipments increased by 3.4% from last quarter, AMD shipments increased 2.3%, Intel's shipments rose 3.6%, and Nvidia's shipments increased 3.8%.

Quick highlights:

The GPU's overall attach rate (which includes integrated and discrete GPUs, desktop, notebook, and workstations) to PCs for the quarter was 117%, down -0.1% from last quarter.

The overall PC CPU market increased by 3.5% quarter-to-quarter and increased 42.1% year-to-year.

Desktop graphics add-in boards (AIBs that use discrete GPUs) decreased by -2.9% from the last quarter.

This quarter saw a 3.4% rise in tablet shipments from last quarter.

The second quarter is typically down compared to the previous quarter, however, this quarter saw GPU shipments increase by 3.4% quarter-to-quarter.

GPUs are traditionally a leading indicator of the market since a GPU goes into every system before the suppliers ship the PC. This quarter the attach rate dropped due to the increase in Chromebook sales.

In a year like no other, suppliers reported shortages of component parts, capacitors, substrates, and other items. Even companies with a diverse portfolio were forced to allocate to the various segments they served. No one was happy about it, and unfortunately, the upcoming inventory build-out for the holiday season that usually takes place in the third quarter will be constrained until the supply chain catches up with demand.

Jon Peddie, President of JPR, noted, “Covid has distorted every forecasting model in the universe—even Moore’s Law has been disrupted. Predictions based on short-term conditions have created conflicting and distorted estimates from some quarters that will be proven wrong and embarrassing.”

Most of the semiconductor vendors are guiding up for the next quarter by an average of 3%. Some of that guidance is based on normal seasonality, but there is still a Coronavirus impact factor and a hangover in the supply chain.