Here's the Q2 2018 discrete video card market report from Jon Peddie Research. First up, the agency observed that GPU board shipments declined 28.0 percent quarter-over-quarter, and 5.7 percent year-over-year, partly due to the drop in demand from cryptocurrency miners.

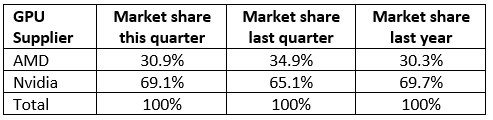

AMD's video cards were pretty popular among miners and this shows in the quarter-to-quarter marketshare statistics. AMD is down from a marketshare of 34.9 percent in Q1 2018 to 30.9 percent in Q2 2018, while NVIDIA rose from 65.1 percent to 69.1 percent in the same timeframe. Compared with the year-earlier period, AMD gained a little bit of marketshare from NVIDIA.

The add-in board market decreased in Q2'18 from last quarter, while Nvidia gained market share. Over $3.2 billion dollars of AIBs shipped in the quarter.

Quarter-to-quarter graphics board shipments decreased 28.0% with a 5.7% decrease year-to-year.

The market shares for the desktop discrete GPU suppliers shifted in the quarter, Nvidia increased market share from last quarter, while AMD enjoyed an increase in share year-to-year. Market share changes quarter-to-quarter, and year-to-year

Add-in boards (AIBs) using discrete GPUs are found in desktop PCs, workstations, servers, rendering and mining farms, and other devices such as scientific instruments. They are sold directly to customers as aftermarket products or are factory installed by OEMs. In all cases, AIBs represent the higher end of the graphics industry with their discrete chips and private, often large, high-speed memory, as compared to the integrated GPUs in CPUs that share slower system memory.

The PC AIB market now has just two chip (GPU) suppliers which also build and sell AIBs. The primary suppliers of GPUs are AMD and Nvidia. There are 48 AIB suppliers, the AIB OEM customers of the GPU suppliers, which they call “partners.”

In addition to privately branded AIBs offered worldwide, about a dozen PC suppliers offer AIBs as part of a system, and/or as an option, and some that offer AIBs as separate aftermarket products. We have been tracking AIB shipments quarterly since 1987—the volume of those boards peaked in 1999, reaching 114 million units, in 2017, 52 million shipped. Since 1981, 2,070 million AIBs have been shipped.

Q2 is normally down from the previous quarter. This quarter it showed a decrease of 28.0% that is -18.2% below the ten-year average of -9.8% which is very low when compared to the desktop PC market, which decreased 3.4% quarter-to-quarter.

On a year-to-year basis, we found that total AIB shipments during the quarter fell 5.7%, while desktop PCs rose 8.8% for the same quarter a year ago, this discrepancy reflects the weakening Crypto-mining market.

Overall, AIBs shipments had been declining slightly, but not as great as the PC due to gaming and Crypto-mining. In 2015 when the use of AIB for cryptocurrency mining became widespread, AIB sales started to rise while PC sales fell. In Q1’18, the demand for AIBs for Crypto-mining ended due to a change from an Ethereum consensus based on the Proof of Work (PoW) system to one based on the so-called Proof of Stake. That change dramatically reduced the need for localized memory, and that made expensive AIBs no longer needed. Also, the price of Ethereum dropped.

However, despite the overall PC churn, somewhat due to tablets and embedded graphics, the PC gaming momentum continues to build and is the bright spot in the AIB market. The impact and influence of eSports has also contributed to the market growth and attracted new users. VR continues to be interesting but is not having a measurable influence on the AIB market.

The gaming PC (system) market is vibrant. All OEMs are investing in the gaming space because the demand for gaming PCs is robust. Intel also validated this on their earnings call when they announced a new Enthusiast CPU. However, it won’t show in the overall market numbers, because like gaming GPUs, the gaming PCs are dwarfed by the general-purpose machines.

Discrete GPUs are the heart and soul of add-in boards (AIBs) and Jon Peddie Research’s Add-in Board Quarterly Report covers the market activity of PC-based graphics for Q1’18.

This detailed 111-page report will provide you with all the data, analysis and insight you need to clearly understand where this technology is today and where it's headed.