The company also scored a huge beat on earnings per share. On an adjusted basis, NVIDIA reported earnings per share of $1.33, up 41 percent year-over-year. That's 26 cents per share better than analyst estimates.

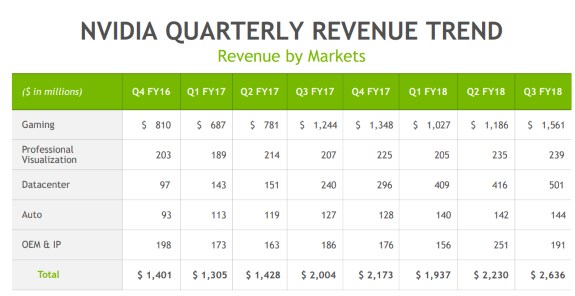

NVIDIA's quarterly revenue trend reveals the company's gaming and datacenter divisions did extremely well. Gaming revenue hit a new all-time high of $1.56 billion, up 25.5 percent year-over-year. Datacenter product sales more than doubled to $501 million, while auto chip sales remained fairly stable at $144 million.

CEO Jen-Hsun Huang attributes the excellent quarter to great performance across all of NVIDIA's growth drivers. For the current quarter, NVIDIA expects revenue of $2.65 billion, plus or minus two percent. NVIDIA rewards shareholders with a 7 percent dividend increase.

The company's shares are currently slightly in the red in after-hours trading, perhaps because investors don't like the flat guidance. NVIDIA is priced as a high-growth stock so it needs more growth to keep the momentum going.

NVIDIA (NASDAQ:NVDA) today reported record revenue for the third quarter ended October 29, 2017, of $2.64 billion, up 32 percent from $2.00 billion a year earlier, and up 18 percent from $2.23 billion in the previous quarter, with growth across all its platforms.

GAAP earnings per diluted share for the quarter were a record $1.33, up 60 percent from $0.83 a year ago and up 45 percent from $0.92 in the previous quarter. Non-GAAP earnings per diluted share were $1.33, also a record, up 41 percent from $0.94 a year earlier and up 32 percent from $1.01 in the previous quarter.

“We had a great quarter across all of our growth drivers,” said Jensen Huang, founder and chief executive officer of NVIDIA. “Industries across the world are accelerating their adoption of AI.

“Our Volta GPU has been embraced by every major internet and cloud service provider and computer maker. Our new TensorRT inference acceleration platform opens us to growth in hyperscale datacenters. GeForce and Nintendo Switch are tapped into the strongest growth dynamics of gaming. And our new DRIVE PX Pegasus for robotaxis has been adopted by companies around the world. We are well positioned for continued growth,” he said.

Capital Return

During the first nine months of fiscal 2018, NVIDIA returned to shareholders $909 million in share repurchases and $250 million in cash dividends. As a result, the company returned an aggregate of $1.16 billion to shareholders in the first nine months of the fiscal year. The company intends to return $1.25 billion to shareholders in fiscal 2018.

For fiscal 2019, NVIDIA intends to return $1.25 billion to shareholders through ongoing quarterly cash dividends and share repurchases. The company announced a 7 percent increase in its quarterly cash dividend to $0.15 per share from $0.14 per share, to be paid with its next quarterly cash dividend on December 15, 2017, to all shareholders of record on November 24, 2017.