Posted on Friday, January 29 2010 @ 20:43 CET by Thomas De Maesschalck

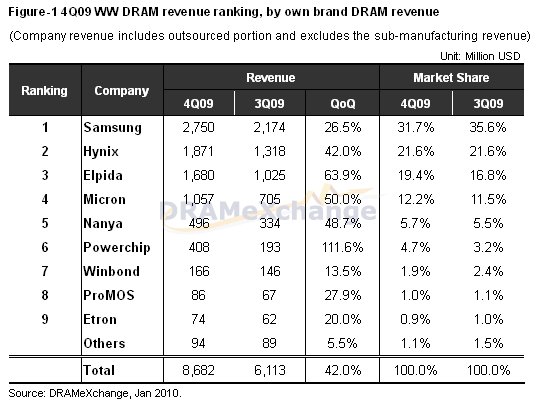

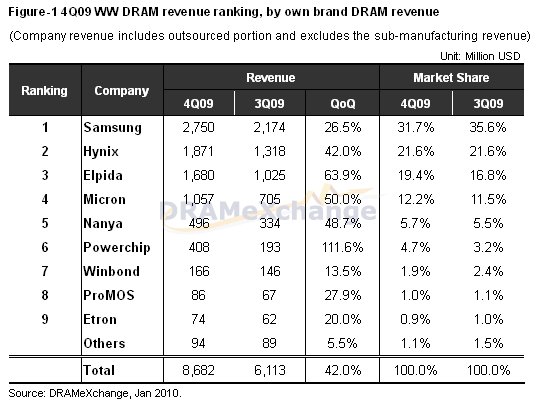

DRAMeXchange reports DRAM memory makers saw their revenue climb by 42 percent in Q4 2009, following a 40 percent revenue growth in Q3 2009. Here's the press release:

-According to DRAMeXchange, 4Q09 revenue has grown 42% due to the hiking DRAM average price and output enhancement, which has shown another progress after 40% revenue growth 3Q09. With the windows 7 launch in end of Oct. and recovering macro-economy, demand in 4Q09 has outperformed our expectation. DDR2 still remained its mainstream memory standard in 4Q09 that demand is much stronger than DDR3 since demand for middle/entry level models looks good. That is, DDR2 shortage happened in 4Q09 and resulted in the up climbing DDR2 contract price in Oct. & Nov. as well as stable pricing level in Dec. Based on we DRAMeXchange check, DDR2 average contract price has sharply raised 61% in 4Q09 while spot price also climbed 68%.

Despite of less shortage impact for DDR3, still DDR3 contract price raised along with the DDR2 that DDR3 contract price increased 40% and 30% for spot price. Regarding to output capacity, 4Q09 DRAM supply bit growth rate is up 20% given the continuous technology migration and pulling-up utilization rate from Taiwanese vendors.

Given the boosting DRAM price and output, DRAM vendors recorded the satisfactory revenue growth in 4Q09. PSC has largely outperformed market average by showing 111.6% revenue growth, followed by Elpida with 63.9% revenue growth.

According to DRAMeXchange, 4Q09 revenue has grown 42% QoQ to USD$8,682M due to the hiking DRAM price and hot PC sales. Despite of 8” fabs phase out, Samsung, the market leader, recorded USD$2,750M quarterly revenue with 26.5% QoQ given the technology migration 50 nm from 40nm, 18% QoQ bit growth and upward DRAM pricing trend. Its leading market share has slightly declined 3.9% to 31.7% due to the below-average revenue grwoth. 4Q09 Hynix DRAM sales rose 42% to US$ 1,871M given the 26% average price growth, 12% quarterly bit growth. Currently Hynix ranks as 2nd place.

Elpida recorded 4Q09 revenue in US$1,680M with 63.9% QoQ benefited from 30% upward DRAM quarterly average price and 30% bit growth. Elpida has strengthened its 3rd market leading position. For the different accounting period (4Q for Micron is Sep., Oct. and Nov.) it applied, contract price rose 21% compared with last periods (Jun., Jul. and Aug.). Benefited from the price and 25% QoQ shipment enhancement in this quarter, Micron recorded US$1,057M quarterly revenue with 50%QoQ revenue growth. Micron grabbed 4th place in the ranking.

As for Taiwanese vendors, Nanya ranks 5th post along with US$496M DRAM revenue and 48.7% QoQ given the upward pricing trend in average quarterly price(44%) and 2% quarterly shipment growth. Benefited from the boosting 68% DDR2 spot price and 45% supply growth rate, PSC shows the amazing 111.6% revenue growth in 4Q09 and market share has increased 1.5% to 4.7%. PSC has shortened the market share gap with Nanya in 4Q09. Winbond announced its 4Q09 DRAM revenue in US$166M with 13.5%QoQ revenue while recorded 1.9% market share. Benefited from the increasing utilization rate to 50% from 21% in 3Q09, ProMOS recorded 27.9% QoQ revenue growth.

The Korean vendor’s share has declined 4.2% to 53.8% in 4Q09 since other vendors indicate higher revenue growth. Japanese vendors’ share has increased 2.6% to 19.6%. Benefited from the sales boosting (111.6%) of PSC, Taiwanese vendors shares has raised 1% to 14.3%. American vendors share increased 0.6% to 12.3%.