Posted on Wednesday, December 23 2009 @ 22:57 CET by Thomas De Maesschalck

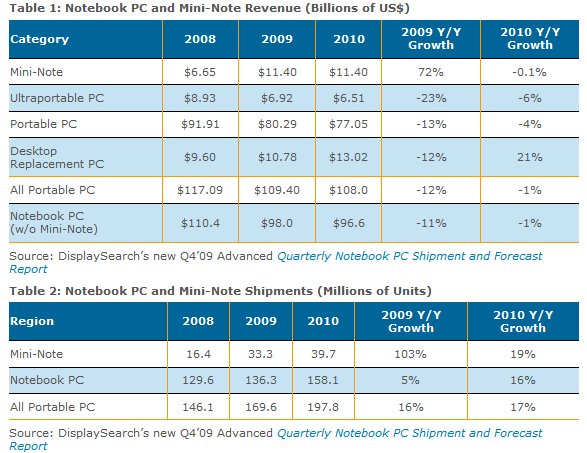

Market research company DisplaySearch reports notebook revenues are expected to be $109 billion in 2009, down almost 7 percent year-over-year. Netbooks were the big winner of the year, shipments of these cheap systems rose by 103 percent to 33.3 million units. Here's the PR:

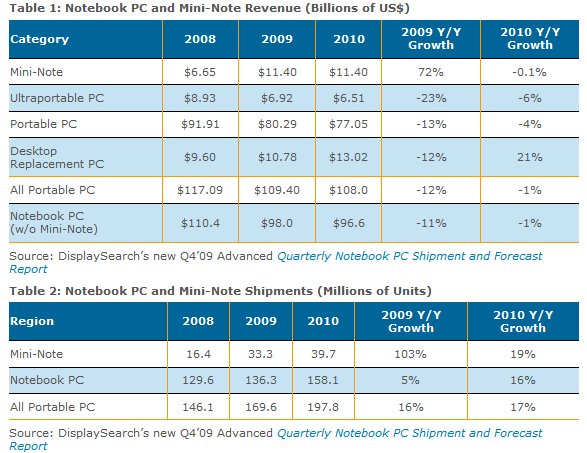

Notebook PC revenues are expected to be $109 billion in 2009, down almost 7% Y/Y, according to the DisplaySearch Q4’09 Advanced Quarterly Notebook PC Shipment and Forecast Report. A dramatic increase in the size of the mini-note (netbook) market has increased the overall size of the portable PC market, but it was insufficient to offset declines in revenue for ultra-portable and portable class notebook PCs (as shown in Table 1). Revenues in every notebook PC category were down Y/Y, and only the portable category (displays from 13” to 16”) posted Q/Q growth. The strong growth of mini-notes drove their revenue share of the portable computer market to 11.7% in Q3’09.

DisplaySearch expects 2009 notebook PC shipment volumes to increase 5% Y/Y in 2009. However, the increase in unit growth is not sufficient to offset the almost 20% decline in ASPs. Mini-note and portable notebook PC (13-16.4”) ASPs are expected to be down more than 15% Y/Y in 2009 and again in 2010. These two market segments account for more than 85% of the total notebook market.

In 2010, DisplaySearch expects the notebook PC market to grow by 16%, with higher than average growth for mini-notes and ultra-portable notebook PCs. Growth in the latter segment is expected to be fueled by numerous new 11.6” and 12.0” products built on CULV platforms and with aggressive, sub-$500 ASPs.

The low prices of mini-notes make these products attractive to buyers seeking a secondary PC for the home, as well as making them more affordable for first-time PC buyers in emerging markets, who are less likely to require all the features available on a larger mainstream notebook PC. The relatively low ASPs also make mini-notes attractive to wireless service providers that hope to add to their revenue by offering subsidized mini-notes with data plan contracts.

“Mini-notes continue to be a significant piece of the notebook PC pie, in terms of both units and revenue. However, our long-term outlook is that the mini-note share of the notebook PC market has stabilized, and will remain at approximately 20% through 2011 before starting to erode. While mini-notes offer lower ASPs and are thinner and lighter than notebook PCs, the performance of larger notebook PCs continues to improve while prices continue to steadily decline, increasing the performance gap while narrowing the price gap.” said John F. Jacobs, Director of Notebook Market Research. “For 2010, we expect further erosion of ASPs across almost every portable computer segment. However, unit growth should be sufficient to offset ASP decline, leading to flat Y/Y revenue for the portable PC market.”