Usually GPU sales decline sequentially in the second quarter but this year is an exception. For the first time in over nine years, GPU sales rose in Q2 2017 and in a very big way too! If you've been following the GPU market a little bit you can probably already guess that the huge demand spike in Q2 2017 was caused by Ethereum mining. Miners bought up huge amounts of video cards and this resulted in shortages and price hikes for gamers.

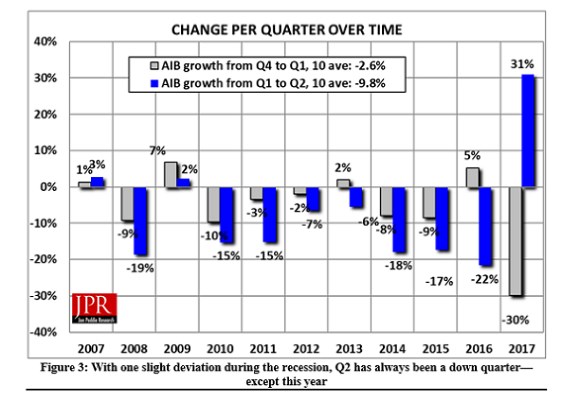

Jon Peddie describes the regular sales pattern of GPUs below:

The GPU and PC market had been showing a return to normal seasonality. That pattern is typically flat to down in Q1, a significant drop in Q2 as OEMs and the channel deplete inventory before the summer months. A restocking with the latest products in Q3 in anticipation of the holiday season, and mild increase to flat change in Q4. All, of that subject to an overall decline in the PC market since the great recession of ’07 and the influx of tablets and smartphones. However, this year, Q2 AIB shipments were completely out of synch, and remarkably high, as shown in the following chart.

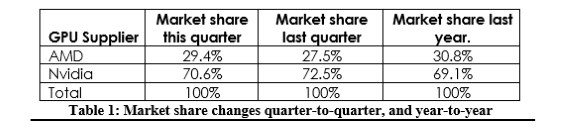

In terms of marketshare, AMD stood at 29.4 percent in Q2 2017, up 1.9 percent versus the first quarter of this year. AMD's gain was NVIDIA's loss but the latter is still the dominant force with a marketshare of 70.6 percent. Jon Peddie estimates $3.6 billion of discrete video cards were shipped in Q2 2017.

Another fun bit of trivia is that Jon Peddie points out that since the introduction of the PC in 1981, an estimated 2.1 billion add-in board video cards will have been shipped by the end of 2017. In inflation-adjusted dollars this totals a whopping $1.02 trillion.