Posted on Wednesday, November 15 2017 @ 15:22 CET by Thomas De Maesschalck

DRAMeXchange reports the pricing of DRAM spiked 16.2 percent in Q3 2017. No relief is expected this year as new highs are expected,

analysts expect a further price hike of 10 percent will be reached this quarter. Especially prices of mobile DRAM will soar significantly, analysts anticipate 10-20 percent higher prices this quarter for that type of DRAM.

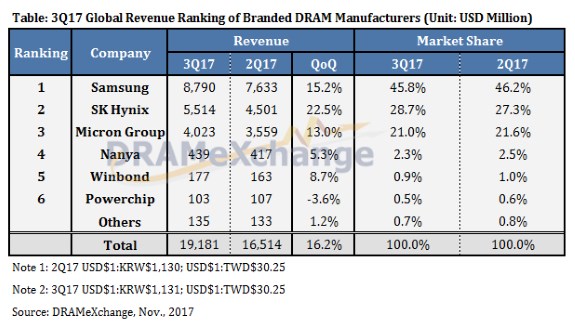

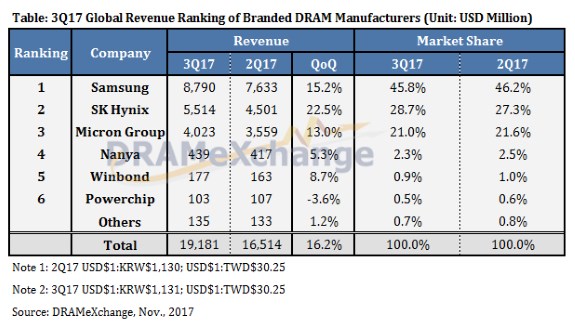

Revenue of the entire global DRAM industry climbed to a new historic high for the third quarter of 2017, reports DRAMeXchange, a division of TrendForce. Contract prices of various DRAM products jumped by about 5% on average in the third quarter from the second quarter on the back of the year-end busy season and limited bit supply growth. As the market still experienced tight supply, total DRAM revenue for the third quarter rose by 16.2% from the second quarter.

Avril Wu, research director of DRAMeXchange, noted that latest fourth-quarter DRAM market outlook indicates that the overall sequential price increase will average around 10%. “Most PC-OEMs have concluded negotiating their contract prices with DRAM suppliers for this fourth quarter,” said Wu, “Contracts with first-tier DRAM suppliers show that the prices of PC DRAM modules have now risen above US$30 and maintained around US$30.5 on average, amounting to a 7% hike from the third quarter. This price increase is mainly attributed to the influence of the booming mobile DRAM market, which is in turn fueled by the limited product supply and the releases of flagship smartphones during the traditional busy season of this year’s second half.”

Wu also noted: “A closer look at the mobile DRAM market has revealed the Samsung has noticeably raised the quotes of its products. To ensure sufficient inventory, smartphone makers generally have no choice but to accept the price increases. Depending on the capacity specifications, prices of mobile DRAM products could go up by 10% to 20% in the fourth quarter compared with the third. As for the server DRAM market, strong demand during the fourth quarter also will push up contract prices of memory modules by 6% to 10% from the previous three-month period.”

Samsung remains the largest DRAM maker in the world with a marketshare of 45.8 percent, followed by SK Hynix with 28.7 percent and Micron with 21.0 percent. Extra production capacity from Samsung will come online soon, that will limit the ability from the other DRAM makers to increase their price as the undersupply situation will become less severe.