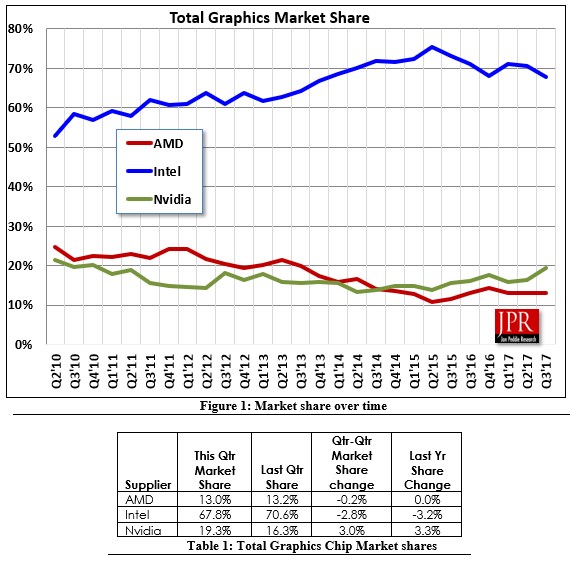

The conclusion after studying the data from Q3 2017 is that graphics chip sales increases 9.3 percent from last quarter, but are down 3.3 percent year-over-year. Desktop graphics sales increased 2 percent while notebook graphics sales fell 6 percent. Jon Peddie says desktop graphics solutions did well thanks to gaming and cryptocurrency demand.

The biggest gainer was NVIDIA with a 29.53 percent quarter-over-quarter increase in shipments. AMD saw its shipments rise by 7.63 percent while Intel saw a 5.01 percent spike. Overall I'm not really a fan of this report, I prefer the discrete GPU report from JPR as it's a much more apples-to-apples comparison. It's pretty interesting though that NVIDIA gained so much marketshare last quarter, you can check out the charts below. It does look that Vega didn't really make a dent in NVIDIA's armor.

The desktop gain is attributed to gaming and cryptocurrency. That helped AMD and Nvidia gain market share.

This is the latest report from Jon Peddie Research on the GPUs used in PCs. It is reporting on the results of Q3'17 GPU shipments world-wide.

The third quarter is typically the strongest from the previous quarter in the seasonal cycles of the past. For Q3'17 it increased 9.3% from last quarter, and was below the ten-year average of 9.52%.

Quick highlights:

AMD’s overall unit shipments increased 7.63% quarter-to-quarter, Intel’s total shipments increased 5.01% from last quarter, and Nvidia’s increased 29.53%. The attach rate of GPUs (includes integrated and discrete GPUs) to PCs for the quarter was 144% which was down -1.28% from last quarter. Discrete GPUs were in 39.55% of PCs, which is up 4.18%. The overall PC market increase 10.31% quarter-to-quarter, and decrease -2.06% year-to-year. Desktop graphics add-in boards (AIBs) that use discrete GPUs increased 29.05% from last quarter. Q3'17 saw an increase in tablet shipments from last quarter.

As mentioned, the normal seasonality has re-established itself in the PC market, albeit in a slowly declining way.

GPUs are traditionally a leading indicator of the market, since a GPU goes into every system before it is shipped, and most of the PC vendors are guiding cautiously for Q4’14.

The Gaming PC segment, where higher-end GPUs are used, was once again the bright spot in the market in the quarter.

The quarter in general

AMD’s shipments of desktop heterogeneous GPU/CPUs, i.e., APUs, increased 7.1% from the previous quarter. AMD's notebook APU shipments were up 2.2%. Desktop discrete GPUs increased 16.1% from last quarter, and notebook discrete shipments increased 5.2%. AMD’s total PC graphics shipments increased 7.6% from the previous quarter.

Intel’s desktop processor graphics shipments increased from last quarter by 5.0% and notebook processors increased by 5.9%, and total PC graphics shipments increased 5.0% from last quarter.

Nvidia’s discrete desktop GPU shipments were up 34.7% from last quarter; and the company’s discrete notebook GPU shipments increased 22.4%, and total PC graphics shipments increased 29.5% from last quarter.

Total discrete GPUs (desktop and notebook) shipments for the industry increased 23.3% from the last quarter, and increased 11.7% from last year. Sales of discrete GPUs fluctuate due to a variety of factors (timing, memory pricing, etc.), new product introductions, and the influence of integrated graphics. Overall, 5-year forecasted CAGR is now -5.8%, which is down from -4.5% last year.

Ninety nine percent of Intel’s non-server processors have graphics, and over 66% of AMD’s non-server processors contain integrated graphics; AMD still ships integrated graphics chipsets (IGPs).

Graphics chips (GPUs) and chips with graphics (IGPs, APUs, and EPGs) GPUs shipments are a leading indicator for the PC market. At least one and often two GPUs are present in every PC shipped. It can take the form of a discrete chip, a GPU integrated in the chipset or embedded in the CPU. The average has grown from 1.2 GPUs per PC in 2001 to 1.44 GPUs per PC.

JPR’s detailed 81-page Market Watch report will provide you with all the data, analysis and insight you need to clearly understand where this technology is today and where it's headed.

Our findings include discrete and integrated graphics (CPU and chipset) for Desktops, Notebooks (and Netbooks). It does not include iPad and Android-based tablets, or ARM-based Servers, or x86-based servers. It does include x86-based tablets, Chromebooks, and embedded systems.

GPUs are traditionally a leading indicator of the market, since a GPU goes into every non-server system before it is shipped, and most of the PC vendors are guiding cautiously for Q4’14. The Gaming PC segment, where higher-end GPUs are used, was a bright spot in the market in the quarter.