A lot of cards went to cryptocurrency miners and Jon Peddie Research believes this market is now saturated. The analyst outfit believes demand will now shift back to gamers, as supply to the retail channel is going up again. Jon Peddie estimates pent-up demand will help to mitigate the usual seasonal decline that's seen in the second quarter of the year for desktop discrete video cards.

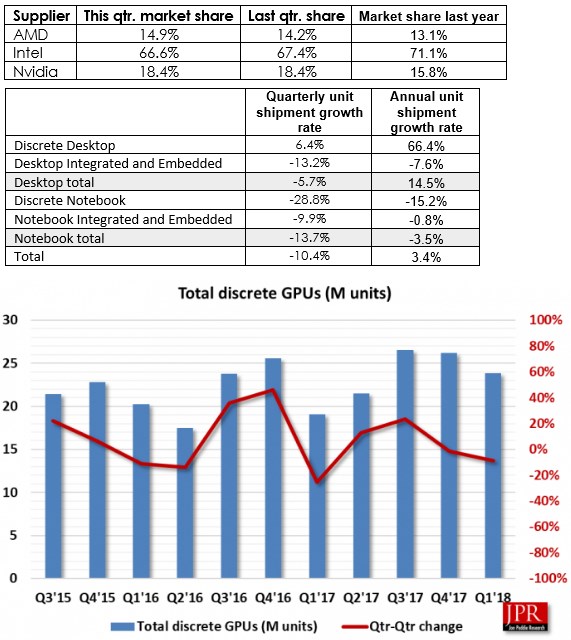

Jon Peddie Research, the industry’s market research firm for the graphics industry, has updated it’s quarterly Market Watch report. Overall, the report finds the crypto-currency market is continuing to influence the PC graphics market, though its influence is waning. Market watch found that year-to-year total GPU shipments increased 3.4%, desktop graphics increased 14%, notebooks decreased -3%. GPU shipments decreased -10% from last quarter: AMD decreased -6%, Nvidia decreased -10%, and Intel decreased -11%.

AMD increased its market share again this quarter benefitting from new products for workstations, and crypto-currency mining, Nvidia held steady, and Intel decreased.

Over three million add-in boards (AIBs) were sold to cryptocurrency miners worth $776 million in 2017. And an additional 1.7 million were sold in the quarter.

We believe the market for crypto-mining AIBs has saturated and the miners who wanted AIBs have got them now. The gamers, who have pulled back on purchases due to t surge-pricing by the channel, are now seeing supply increase and prices coming back down. We think they represent a pent-up demand which will carry forth into Q2 and will help mitigate the usual seasonal decline in the second quarter for desktop discrete GPU sales.

However, the PC suppliers, the supply chain in Taiwan and China, and the semiconductor suppliers are all guiding down for Q2 reflecting a continuation of historic seasonality, and a general decline in the PC market. Nonetheless, the supply chain companies in Taiwan are predicting that this Q2 will be the bottom for the PC market decline.

The first quarter is typically flat to down from the previous quarter in the seasonal cycles of the past. For Q1'18, it decreased -10.4% from last quarter and was below the ten-year average of ?6%.

Quick highlights

AMD’s overall unit shipments decreased -5.83% quarter-to-quarter, Intel’s total shipments decreased -11.49% from last quarter, and that of Nvidia’s decreased -10.21%. The attach rate of GPUs (includes integrated and discrete GPUs) to PCs for the quarter was 140% which was up 5.75% from last quarter. Discrete GPUs were in 39.11% of PCs, which is up 2.23%. The overall PC market decreased -14.12% quarter-to-quarter and increased 0.46% year-to-year. Desktop graphics add-in boards (AIBs) that use discrete GPUs increased 6.39% from last quarter. Q1'18 saw a no change in tablet shipments from last quarter.

GPUs are traditionally a leading indicator of the market, since a GPU goes into every system before it is shipped, and most of the PC vendors are guiding cautiously for Q2’18.