Posted on Monday, December 07 2020 @ 11:18 CET by Thomas De Maesschalck

Analyst outfit Jon Peddie Research reports AMD gained quite a bit of GPU marketshare in Q3 2020.

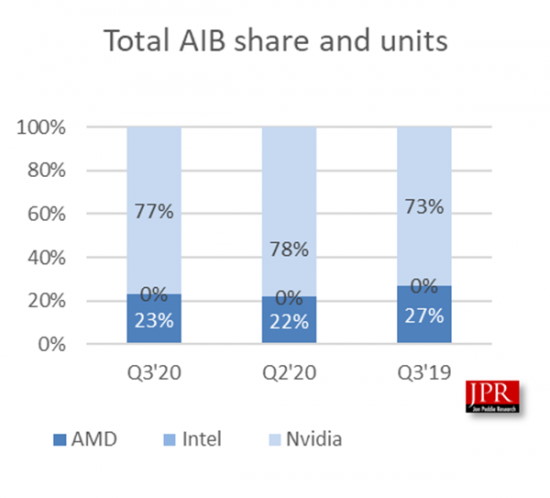

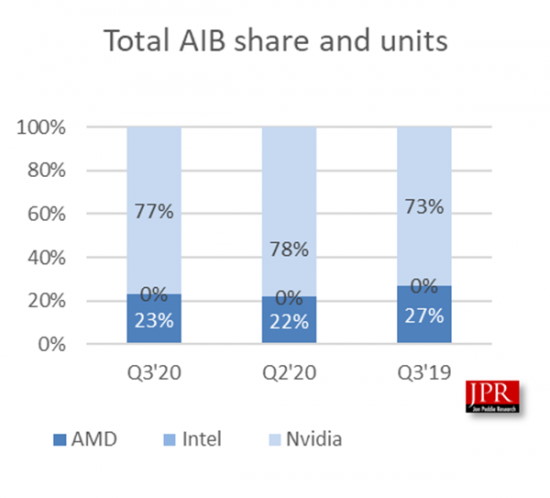

Shipments of discrete video card rose 9.1 percent year-over-year and 13.4 percent quarter-over-quarter. AMD now has a marketshare of 27 percent, which is 5 percent higher than in Q2 2020. There are still only two major players in the discrete video card market so AMD's gain means NVIDIA's marketshare dropped 5 percent to 73 percent.

As part of its Market Watch and Add-in-Board report subscription services, Jon Peddie Research has continuously tracked GPU shipments. As a follow-on to its recent Market Watch Report, JPR is releasing the latest Add-in-Board quarterly report.

The add-in board market increased in Q3'20 from last quarter, and AMD gained market share. Over $4.2 billion of AIBs shipped in the quarter.

Quarter-to-quarter graphics add-in board shipments increased significantly by 13.4% and increased by 9.1% year-to-year.

The market shares for the desktop discrete GPU suppliers shifted in the quarter. AMD market share increased from last quarter, Nvidia increased its position from the previous year.

Market share changes quarter-to-quarter, and year-to-year

Add-in boards (AIBs) use discrete GPUs (dGPU) with dedicated memory. Desktop PCs, workstations, servers, rendering, mining farms, and scientific instruments use AIBs. Consumers and enterprises buy AIBs from resellers or OEMs. They can be part of a new system or installed as an upgrade to an existing system. Systems with AIBs represent the higher end of the graphics industry. Entry-level systems use integrated GPUs (iGPU) in CPUs that share slower system memory.

The PC AIB market currently has two dGPU suppliers, which also build and sell AIBs. The primary suppliers of GPUs are AMD and Nvidia. There are 54 AIB suppliers. They are the AIB OEM customers of the two major GPU suppliers, which they call “partners.” Some of the AIB suppliers offer AMD and Nvidia-based products, and others provide only one or the other.

There are private branded AIBs offered worldwide. Also, about a dozen PC suppliers offer AIBs as part of a system and/or as an option. Many OEMs offer AIBs as aftermarket products. We have been tracking quarterly AIB shipments since 1987. Those boards’ volume peaked in 1999, reaching 114 million units when every PC had a graphics AIB in it. This quarter 11.5 million shipped.

“The AIB market reached $14.8 billion last year,” said Dr. Jon Peddie. “We forecast it to be $20.3 billion by 2023. Intel entered the OEM AIB market in Q4’20. The company will introduce a consumer AIB by Q2’21. Since 1981, 2,077 million AIBs have shipped.”

The third quarter has the highest volume of shipments for most years.

This quarter it was up 13.4% from the last quarter. That is below the ten-year average of 17.1%. It is higher than the desktop CPU market, which increased by 8.5% from the previous quarter.

AIB sales have been more robust than usual. That has been due to a couple of factors. One is the continued growth in gaming. The other is the outfitting of home offices due to COVID. There may have been some sales to crypto-miners too.

On a year-to-year basis, we found total AIB shipments during the quarter rose 9.1%. That is greater than desktop CPUs, which fell -14.2% from the same quarter a year ago.

AIBs shipments had been declining, but not as great as the PC. That was due to content creation users and continued strong demand from gamers. In 2015 AIBs used for cryptocurrency mining became widespread; AIB sales started to rise while PC sales fell. There has been a similar rise in AIB sales over PCs for the past two quarters.

Despite the PC churn, somewhat due to tablets and embedded graphics, the PC gaming momentum continues to build. It is the bright spot in the AIB market. The impact and influence of eSports have also contributed to market growth and in the process, has attracted new users. VR continues to be exciting but it is not having a measurable influence on the AIB market.